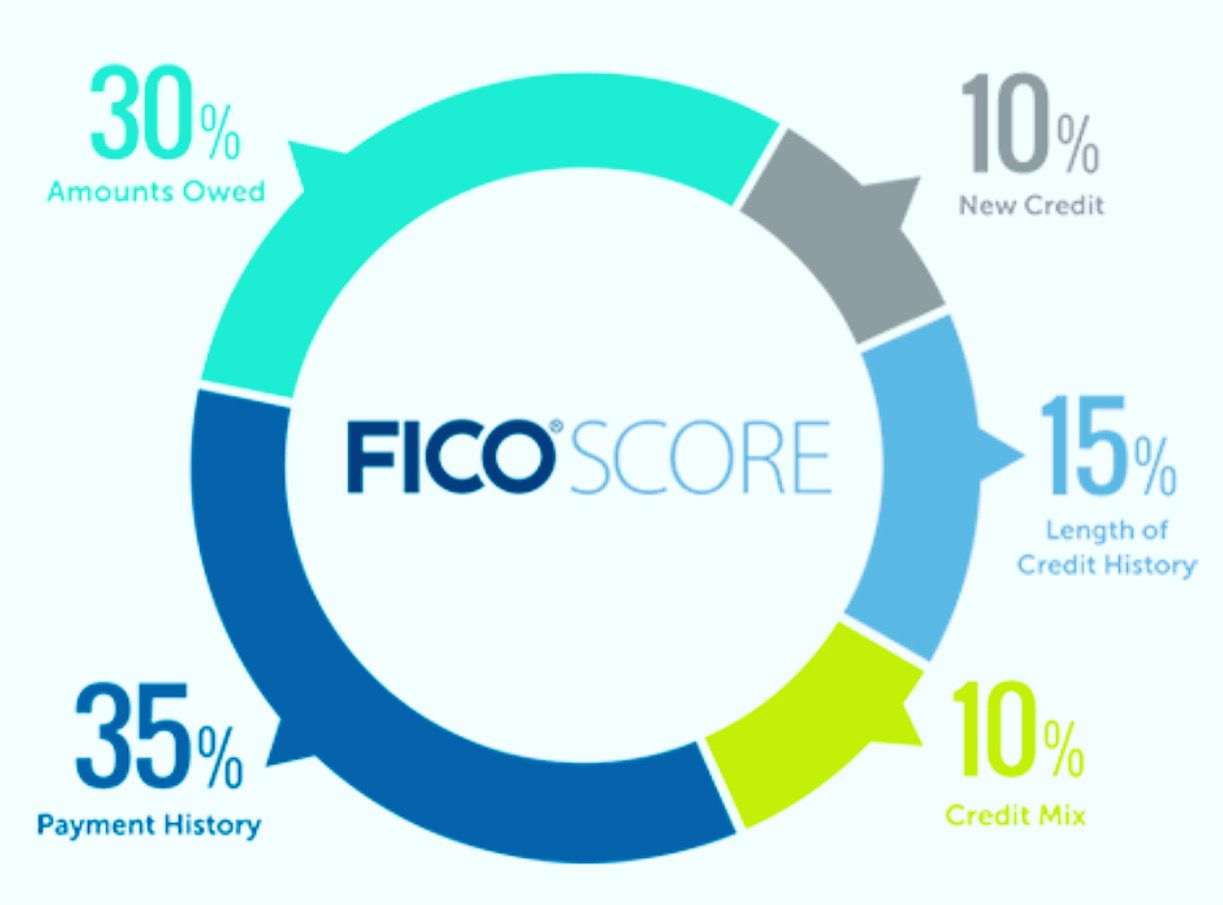

This chart shows the importance of each deciding factor.

1) Payment History – Have you consistently made payments on time?

2) Utilization – Minimum and maximum usage of debt both have impacts on the score.

3) Length of History – The longer history you have of paying the better.

4) Type of Credit – Keep a healthy mix of various debts. Credit cards, car loan, mortgage, etc

5) New Credit – Too many accounts at once might send a message you need help keeping up with your expenses.

Remember these when managing your debt to help improve your score!